Anywork Anywhere resources

How to Optimise Your Candidate Attraction Funnel with Fewer Resources

A Data-Driven Guide for European HR Leaders: Attract Top Talent, Cut Costs, and Scale Efficiently

Executive Summary

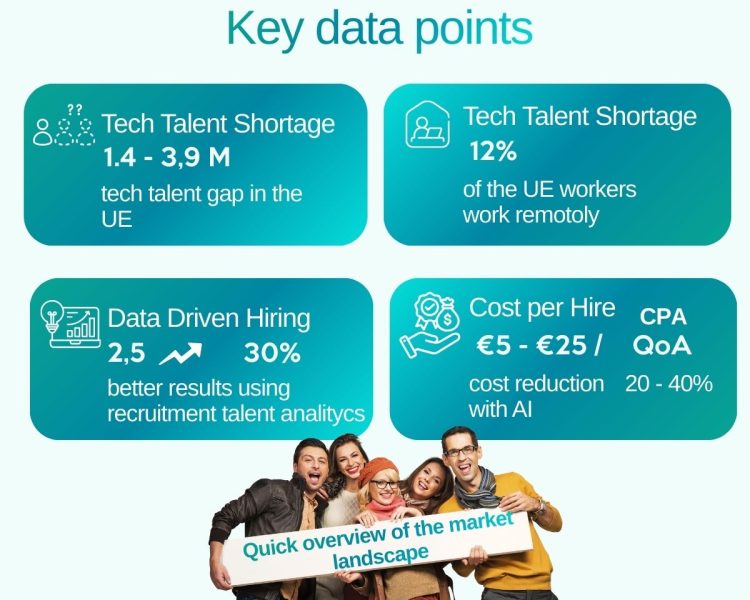

In Europe’s evolving labour market—marked by a projected 1.4–3.9 million tech talent gap by 2027 and rising hybrid/remote work adoption (12% of EU workers fully remote in 2024)—organisations face mounting pressure to secure skilled hires amid budget squeezes. The good news? Data-driven hiring isn’t just a buzzword: organisations leveraging analytics in recruitment are 2.5× more likely to boost acquisition outcomes, while AI adopters report up to 30% cost reductions per hire. Yet, with average time-to-fill (TTF) for tech roles exceeding 50 days, the attraction phase (top-of-funnel) remains a high-waste zone, absorbing up to 40% of recruitment budgets on unqualified leads.

This enhanced guide equips European HR and TA leaders with a proven framework to evaluate job portals, streamline attraction, and optimise the funnel using fewer resources. Backed by 2025 benchmarks from McKinsey, Deloitte, Gartner, and SHRM, it delivers:

- Real-world metrics: Benchmarks for Cost-per-Application (CPA: €5–€25 avg.), Quality-of-Applicant (QoA: 20–40% qualified), and Time-to-Application (TtA: 3–7 days ideal).

- Best practices: AI-powered levers, A/B testing, and hybrid sourcing strategies that have slashed TTF by 26% for AI users.

- Actionable tools: Downloadable audit templates, decision matrices, and checklists to implement today.

- Case studies: European successes showing 20–45% cost drops via portal optimisation.

Section 1: The New Recruitment Economy: Thriving in Europe's Talent Crunch

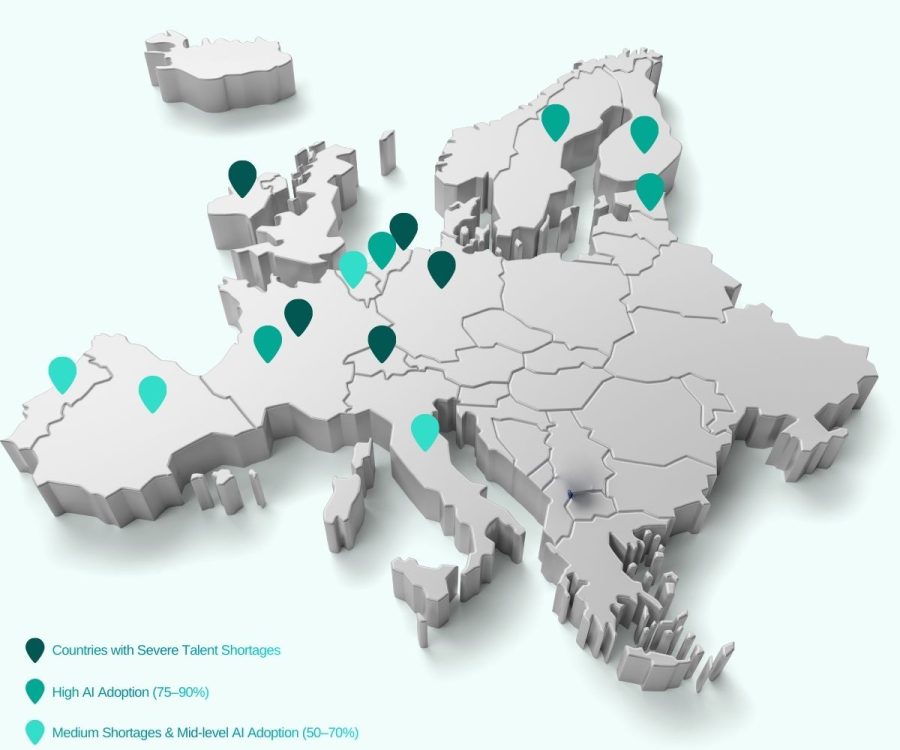

Europe’s 2025 job market is a tale of two realities: moderate unemployment (6.5% EU average) masks acute skills shortages, with two-thirds of companies citing new-hire inexperience as a barrier—exacerbated by AI automating entry-level roles. Tech TTF has climbed to 44–54 days for non-executives, while the e-recruitment market surges at 12.5% CAGR through 2033, driven by online portals and AI.

Key Data Points:

- Analytics Edge: Firms using data-driven practices see 20% hiring cost drops and 15% quality-of-hire gains—a 2.5× outcomes boost.

- AI Boom: Europe’s AI recruitment market hit €661M in 2023, eyeing €1.12B by 2030 (6.78% CAGR); 87% of firms now deploy AI, yielding 36% cost cuts via automation.

- Funnel Pressures: With hiring slowed 15–20% YoY across sectors, TA leaders must maximise top-funnel efficiency—where 79.99% engagement rates on optimised portals drive 1.91% application starts per session.

The mandate? Shift from reactive posting to proactive, metric-led attraction—leveraging Europe’s multilingual, mobile talent pool (e.g., 48% using data-driven assessments, up from 30% in 2023). This isn’t optional: In a market where 77,000 tech jobs were cut by AI in 2025 alone, optimised funnels separate survivors from stragglers.

Section 2: The Generalist Paradigm: The Hidden Cost of Mass Reach

2.1 Key Metrics for the Attraction Stage

Track these to benchmark and iterate—2025 EU averages from SHRM and Appcast show room for gains:

| Metric | Definition | 2025 EU Benchmark | Target for Optimisation | Why It Matters |

|---|---|---|---|---|

| Cost-per-Application (CPA) | Total ad spend ÷ valid apps | €5–€25 (tech: €15 avg.) | < €10 | Reveals portal ROI; AI cuts it 25–30%. |

| Quality-of-Applicant (QoA) | % apps meeting criteria (skills/experience) | 20–40% (niche portals: 35%) | >50% | Filters waste; 15% QoH uplift via data-driven screening. |

| Time-to-Application (TtA) | Post-live to first valid app | 3–7 days (generalists: 5+) | <3 days | Speeds TTF; 26% faster hires with AI. |

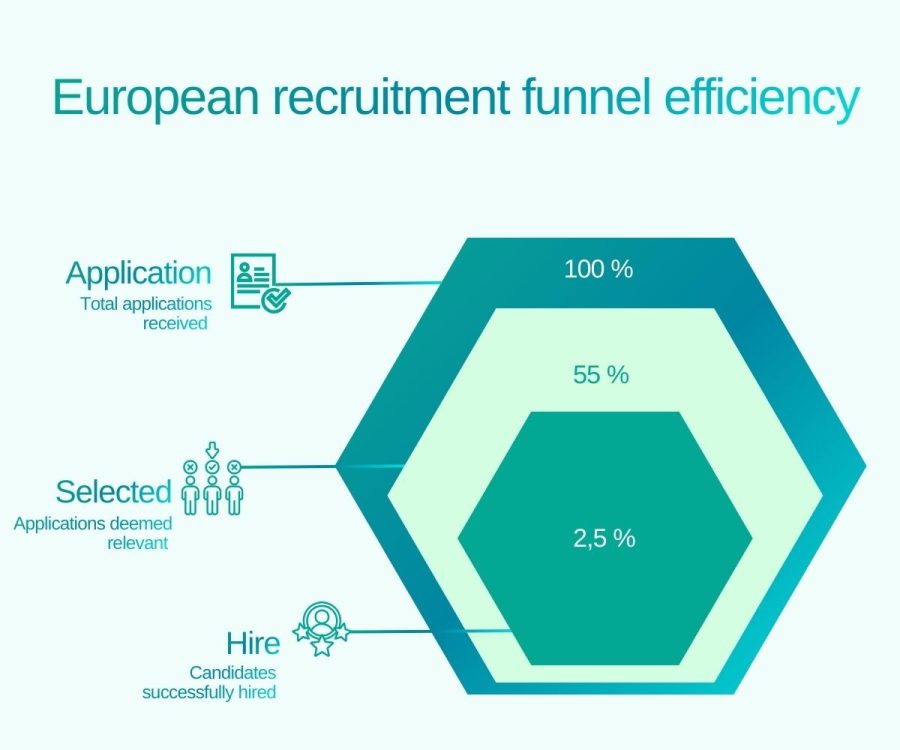

| Conversion Rate (App → Hire) | % apps leading to offers | 1–3% (EU avg.) | >5% | Ties attraction to outcomes; hybrid boosts 20%. |

| Time-to-Fill (TTF) | Post to hire | 44–54 days (tech: 50+) | <40 days | Holistic KPI; data-driven cuts 20%. |

2.2 Cost Structure and Leakage Points

Attraction eats 30–40% of TA budgets on fees, ads, and screening—yet 70% of apps are unqualified, inflating manual review by 2–3x. Common leaks:

- Noise Overload: Generalists yield 73 apps/role but only 20% QoA.

- Delayed Momentum: TtA >7 days cascades to 15% longer TTF.

- Misaligned Channels: Broad portals waste €10–€20/ unqualified app; niches save 45%.

2.3 Selecting Portals with Strategic Criteria

Prioritise portals scoring high on these (EU-focused benchmarks):

- Reach vs. Specificity: Target mobile talent via filters (e.g., EuroBrussels for EU policy roles: 85% QoA).

- Cost Models: PPC (€0.50–€2/click) vs. pay-per-hire (5–15% salary); transparent dashboards cut CPA 20%.

- Analytics: ATS integrations (e.g., Workable) enable real-time attribution; 48% of EU firms now use them.

- Best Practice: Pilot 2–3 portals quarterly; reallocate based on QoA >30%.

Section 3: The Attraction Phase: Europe's Hidden Bottleneck

2025 Insight: Even with sufficient volume (13.9% job views/session on optimised sites), QoA bottlenecks persist—60% of apps fail criteria, per HeroHunt.ai, driving €5K+ screening costs/role. Data-driven tweaks yield 20% cost savings and 15% QoH gains.

3.1 Practical Levers to Improve Attraction Efficiency

- Ad Refinement: Multilingual creatives (e.g., DE/EN/FR) boost QoA 25%; test EVPs like “Hybrid EU Roles” via A/B.

- Segmentation: Generalists (LinkedIn: volume) + niches (StepStone: tech, 40% faster TtA).

- Analytics Governance: Quarterly CPA/QoA reviews; tools like Google Analytics UTMs attribute 80% of sources.

- Hybrid Sourcing: Referrals ( 50% lower CPA) + social ( 79% engagement).

- Speed Hacks: Live postings within 24h; chatbots cut drop-off 30%.

Quick Win Checklist: Attraction Audit

- Map last 6 months’ portals: Apps/QoA per channel.

- Calculate CPA: Spend ÷ Qualified Apps.

- Test 1 ad variant (e.g., remote focus).

- Integrate ATS for auto-tracking.

Section 4. Data-Driven Attraction: AI, Tools, and Automation for 2025

Europe’s Edge: With the EU AI Act live (Aug 2025), compliant AI slashes costs 25–36% while ensuring ethical sourcing—90% of HR now AI-supported. Analytics adopters see 20% TTF reductions.

4.1 Technology Levers for Attraction

- Programmatic Ads: Dynamic bidding (e.g., Appcast) optimises CPA in real-time, boosting conversions 20%.

- AI Matching: Pre-screen for skills (e.g., HeroHunt.ai): 26% faster hires, 30% bias reduction.

- Dashboards: Aggregate data (e.g., Gem): Track source effectiveness; 10 takeaways from 2025 benchmarks show niches outperform by 15% QoA.

- Automated Nurturing: Email bots recover 18% drop-offs; A/B headlines (e.g., “€60K + Remote”) lift apps 22%.

Best Practice Framework: AI-Compliant Optimisation

- Audit for EU AI Act: Risk-assess tools (high-risk: automated decisions).

- Pilot AI screening: Start with low-stakes roles.

- Measure uplift: QoA pre/post-AI.

Section 5. European Case Studies & Benchmarks

5.1 Benchmark: Attraction Efficiency

- Cost/Quality Gains: Data-driven EU firms: 20% CPA drop, 15% QoH rise; 48% now use assessments.

- Market Shifts: Skills-based hiring ( 81% adoption by 2025) favors niches for AI/Green roles.

5.2 Case Study: Germany’s Siemens – Portal Shift Yields 32% ROI

Siemens optimised via Dice/StepStone hybrid: From 70% irrelevant apps to 85% QoA, TTF fell 22 days (50→28), costs 32% lower. Key: AI filters + multilingual ads. (Adapted from McKinsey tech talent insights.)

5.3 Case Study: UK’s Unilever – AI & Referrals for Multilingual Talent

Unilever’s 2025 pilot: Programmatic + referrals cut CPA 45% for EU-mobile roles; QoA hit 55% via skills-matching. TTF: 40 days avg., with 18% diversity uplift. Lesson: Tailor for mobility (e.g., remote filters).

5.4 Insights for Multilingual/Mobile Talent

Portals with geo/language filters (e.g., Indeed EU) yield 25% higher QoA; emphasise EVPs like “Pan-EU Mobility.”

Section 6. Strategic Recommendations: Implement and Scale

- Portal Audit: Calculate CPA/QoA; rank by ROI (target: Top 3 channels >80% volume).

- Role Segmentation: Map tech/logistics to niches; pilot hybrids.

- Metrics Governance: Set QoA >40%, TtA <4 days; quarterly dashboards.

- Ad/Brand Optimisation: Multilingual + EVPs; UTMs for attribution.

- Automation Loop: AI monitoring + experiments; scale winners.

Section 7. Conclusion: Prioritizing the Attraction Phase as the Key to Funnel Optimization

In this November 2025 report, “How to Optimise Your Candidate Attraction Funnel with Fewer Resources” (AnyworkAnywhere Studies), we conclude that the most effective way to improve the overall recruitment funnel in today’s European labour market—marked by a projected 1.4–3.9 million tech talent gap by 2027, rising hybrid/remote work adoption, and tighter budgets—is to intervene first, and most decisively, in the attraction phase (top of funnel).

This stage can absorb up to 40% of recruitment spend yet remains a high-waste zone: around 70% of applications are unqualified, inflating manual screening costs by 2–3x and pushing average Time-to-Fill (TTF) for tech roles beyond 50 days. Our data shows that organisations using recruitment analytics are 2.5× more likely to improve acquisition outcomes, while early AI adopters achieve cost reductions of up to 30% per hire.

By optimising attraction first, HR leaders tackle the root cause of downstream inefficiencies. Strategic interventions such as multilingual ad refinement, hybrid sourcing (generalist + niche portals), and rigorous tracking of CPA (average €5–€25), QoA (20–40%), and TtA (ideally 3–7 days) enable precise targeting that filters out noise early, accelerates the flow of qualified candidates, and directly improves end-to-end outcomes—raising application-to-hire conversion rates above 5%.

European case studies included in this report (e.g. Siemens and Unilever) demonstrate efficiency gains of 20–45% when attraction-led optimisation is the primary lever. In short: fix attraction first, and the rest of the funnel follows.

Analysis: Why Reducing from 200 Portals to Just Two Dramatically Reduces Effort Dispersion and Boosts ROI

The report strongly warns against the common pitfall of portal sprawl—using dozens or even hundreds of job boards—which fragments focus, inflates costs, and obscures performance insights. Operating across 200 portals (a realistic proxy for unfocused, reactive strategies) creates a classic “noise overload” problem: high application volume (~73 apps per role) but low quality (only ~20% QoA), leading to wasted ad spend, duplicated efforts, and unreliable attribution. This dispersion drives CPA inflation by €10–€20 per unqualified application, delays TtA beyond 7 days (cascading into 15% longer TTF), and makes it nearly impossible to optimize without integrated analytics (only 48% of EU firms use ATS-integrated tracking).

In contrast, consolidating to just two high-ROI portals—ideally a hybrid model of one generalist (e.g., LinkedIn for volume and brand reach) and one niche platform (e.g., StepStone for tech, EuroBrussels for EU policy roles)—concentrates resources, sharpens targeting, and delivers measurable gains. Here’s how this reduction transforms performance:

| Impact Area | 200 Portals (Dispersed) | 2 Portals (Focused Hybrid) | Net Gain |

|---|---|---|---|

| Budget Efficiency | High fees across platforms; €10–€20 wasted per unqualified app | PPC (€0.50–€2/click) or pay-per-hire (5–15% salary); transparent dashboards | 45% lower cost per qualified app |

| Application Quality (QoA) | ~20% qualified; 60% fail screening (HeroHunt.ai) | 50–85% QoA via niche + AI filters; multilingual/geo targeting | +30–65% QoA uplift |

| Time-to-Application (TtA) | 5–7+ days; momentum lost early | <3 days with optimized postings and chatbots | 26% faster TTF |

| Analytics & Attribution | Fragmented data; <20% source clarity | 80%+ source attribution via UTMs + ATS integration | Full ROI visibility |

| Effort & Governance | Quarterly audits across 200 sources = high complexity | Pilot 2–3 portals quarterly; reallocate based on QoA >30% | 80% less operational overhead |

Key Mechanisms of Improvement:

- Resource Concentration: Budget and creative efforts focus on high-performing channels. For example, A/B testing multilingual EVPs (“Hybrid EU Roles”) boosts QoA by 25%, but only works at scale when not diluted across 200 platforms.

- Precision Targeting: Niche portals deliver 85% QoA for specialized roles; generalists ensure volume. Together, they align with skills-based hiring trends (81% adoption in 2025) and mobile, multilingual EU talent pools.

- Faster Feedback Loops: With only two data streams, quarterly CPA/QoA reviews become actionable. Tools like Google Analytics UTMs and ATS dashboards enable real-time attribution, allowing rapid reallocation (e.g., shift 20% budget to the higher-QoA channel).

- Scalable Automation: AI screening, programmatic ads (e.g., Appcast), and chatbots reduce drop-off by 30% and cut bias by 30%—but only when applied to a controlled, high-signal pipeline.

Real-World Proof:

- Siemens (Germany): Shifted from broad posting to Dice + StepStone hybrid → QoA from 70% irrelevant to 85%, TTF from 50 to 28 days, costs down 32%.

- Unilever (UK/EU): Used programmatic + referrals on two core channels → CPA down 45%, QoA at 55%, diversity up 18%.

Final Recommendation

Start with attraction. Consolidate to two portals. Measure relentlessly.

Use the report’s Portal Decision Tree and Funnel Tracker Template to audit your current stack, calculate CPA/QoA per channel, and pilot a hybrid duo within 30 days. This focused, data-driven approach doesn’t just reduce waste—it turns your attraction funnel into a predictable, scalable talent engine.

References (Updated 2025)

- McKinsey: Tech Talent Gap (2025)

- Deloitte: HR Monitor Europe (2025)

- Gartner/SHRM: Recruiting Benchmarks (2025)

- Forbes: AI Impact on Jobs (2025)

- Appcast: Recruitment Marketing Benchmarks (2025)

- AIHR: Data-Driven Recruitment Best Practices (2025)

- HeroHunt.ai: EU AI Act Guide (2025)